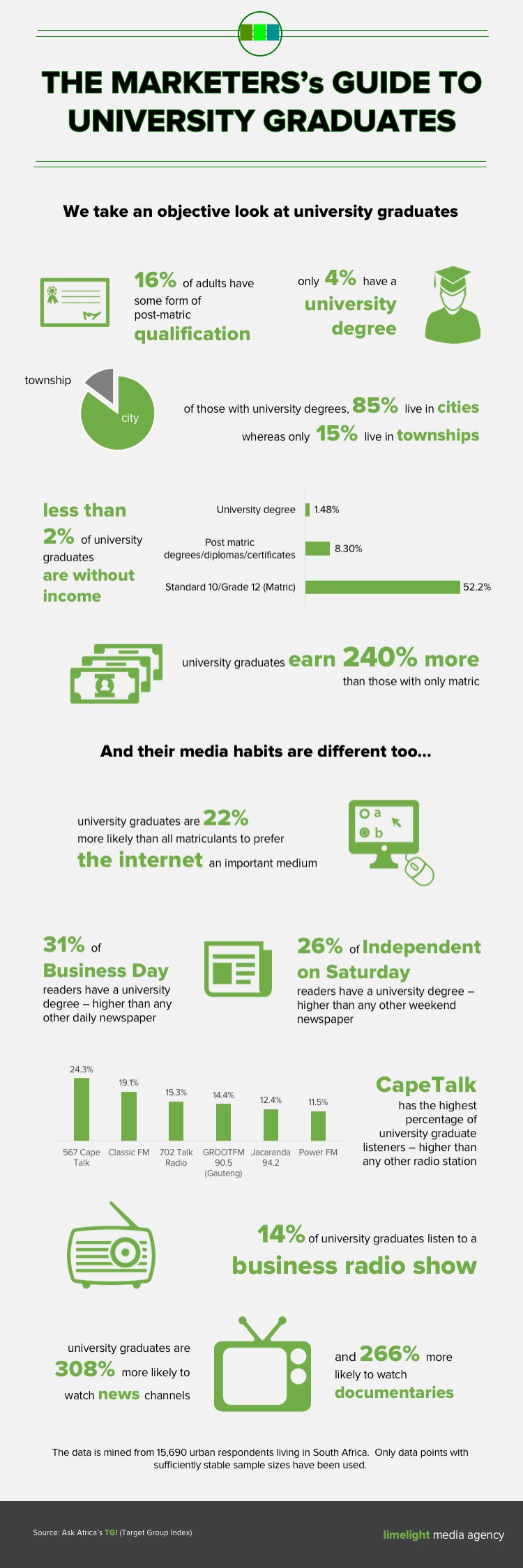

Infographic: University graduates

With a nation grappling with a solution to providing higher education to all, we have an objective look at university graduates in South Africa and how to target them through media.

Firstly, and sadly, they are a small minority of our country. Only 16% of urban adults have some for of post-matric qualification and only 4% have a university degree.

These university graduates live mostly in the cities (85%) whereas only 15% live in townships.

A university education has a profound effect on one’s earning capacity – shown by the fact that only 2% of university graduates are without a personal income and those that do have an income, earn 240% more than the average matriculant.

Their media habits, too, are different. University graduates are 22% more likely to prefer the Internet as an important medium of communication.

Amongst newspapers, Business Day is the daily newspaper which has the most readers with a university degree (31% of readers) whereas the Independent on Saturday is the weekend newspaper with the highest percentage (26%).

Amongst radio stations, CapeTalk stands out high with the highest percentage of listeners with a university degree (24%) but is followed closely ClassicFM, 702, GrootFM, Jacaranda and Power FM. Furthermore, 14% of university graduates listen to business radio shows.

General television viewership doesn’t change much but specific DSTV channels do – university graduates are 308% more likely to watch news channels and 266% more likely to watch documentaries.

DSTV growth over the last 5 years

With DSTV’s recent price hike (rather big) we take a quick look at the growth of viewers.

Infographic: Profile of Internet users in South Africa – debunking misconceptions

A common misconception amongst marketers is around the ages, race, and income level of people using the Internet in South Africa.

Infographic: Debunking marketer’s misconceptions about race profiles of media consumption in South Africa

It’s quite common that many of us (myself included) have certain perceptions of ‘white’ magazines and ‘black’ radio stations.